Your Multifamily Lending Update by EM CAPTIAL LLC.

Here’s the latest news from the major multifamily lenders:

GSE: Fannie/Freddie: Business is not usual

Fannie/Freddie continue refinance activity and providing liquidity to the Multifamily market as they fund loans against properties through the pandemic. They have set up new requirements that call for borrowers to set up additional reserves to cover debt-service for months to hedge against a decline in rental income. Lending requirements are also tightening.

Freddie Mac (as of 4/10):

Created a nationwide relief plan for Freddie multifamily borrowers and their residents. Operators with a multifamily Freddie performing loan can now defer their loan payments for 90 days. Freddie is also now requiring no evictions of any tenant based solely on non-payment of rent during the forbearance period. Freddie will continue to issue new securitizations across their core offerings: K-Fixed, Floating, and SBL with a Freddie Mac loan to defer loan payments for three months. This program could potentially apply to as many as 27,000 properties that currently have performing Freddie Mac loans. This may reach more than 4.2 million renters, according to the agency. The latest census data shows that there are more than 40 million renters in the US.

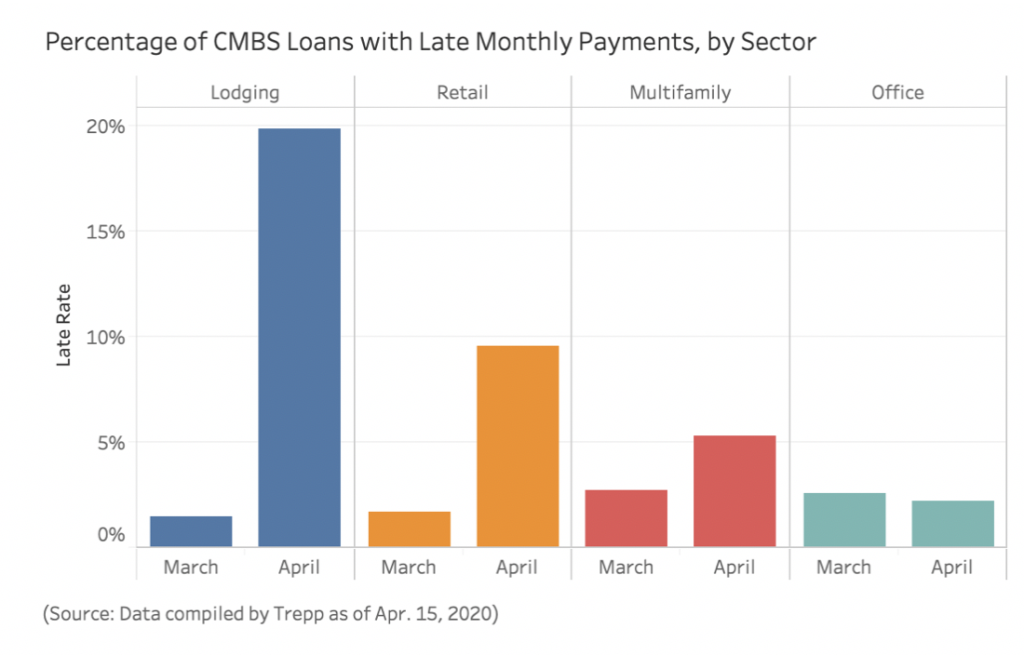

Multifamily and office assets with CMBS Loans are currently showing the lowest late payment rates for march and April. Though the rates for Multifamily properties have nearly doubled from 2.7% to 5.3% from March to April.

Showing continued stability. They are actively quoting deals but experiencing a low signing rate due to buyer uncertainty. Short-term are bottoming out at 3%, and 3.75-4.25% for a longer term. Again, their underwriting remains conservative, but debt service reserves are beginning to act as a medium to conduct new business.

Lending relatively unaffected, expected to increase volume during this crisis.